By Field & Bean Team

Key points on the path to supporting agriculture’s growth

Ever since Kevin Costner heard a voice from his cornfield whisper, “If you build it, he will come,” businesses from every industry have used this memorable movie quote to underline an important idea: If you make an investment – if you build something of value and indelible meaning – eventually, the idea will pay off.

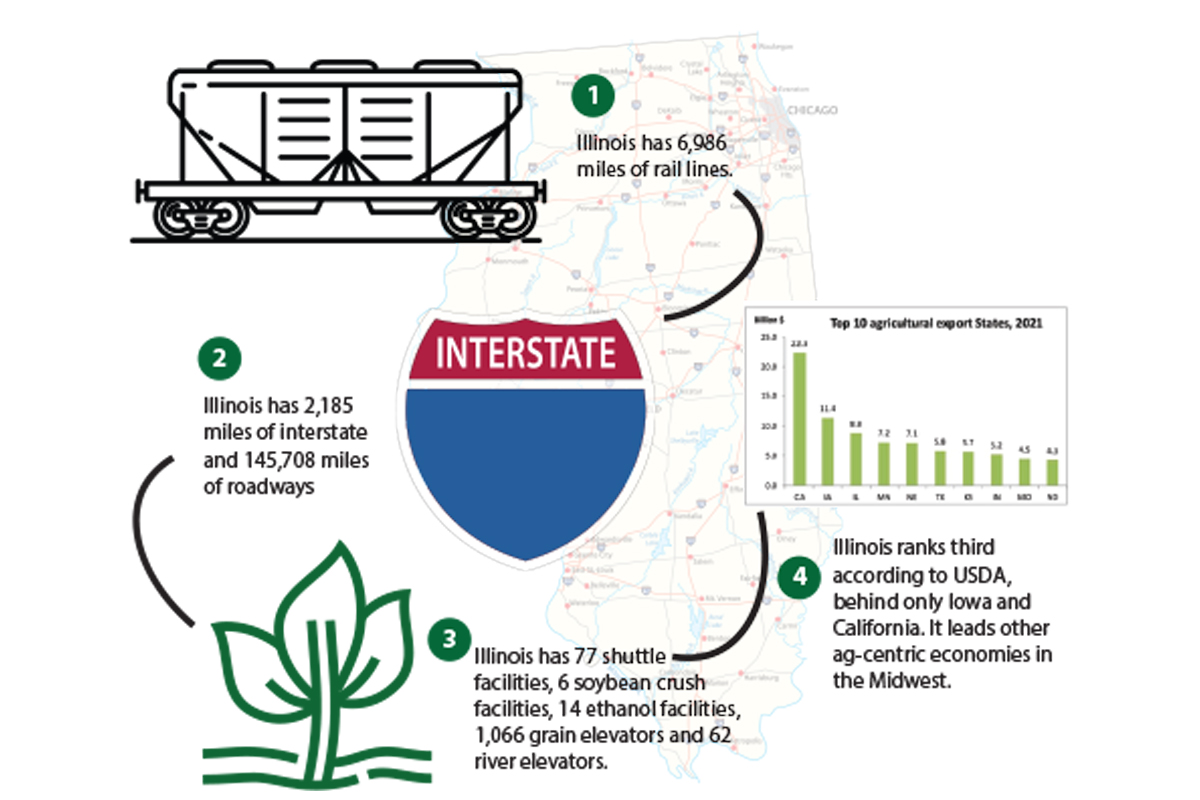

Our transportation infrastructure is one of Illinois soy’s most vital global competitive advantages—and in turn, that infrastructure’s aging is one of our most critical issues. How do we make investments now, so we have not only a resilient transportation system but one that also maintains our competitive advantage?

ISA already has begun to map out what needs to be implemented to create an ag-centric transportation system and how we best support those initiatives. You already know Illinois is the largest soybean producer in the U.S. We grew 677 million bushels in 2022. But here’s something you might not know: “Ag is the No. 1 sector of the Illinois economy reliant on the transportation network,” says Todd Main, ISA Director of Market Development.

That kind of volume puts pressure on an aging infrastructure. And ISA is working hard to ensure soybean production numbers keep increasing while the transportation system becomes more resilient so ag output and infrastructure move forward together.

ISA has a goal of 15 percent growth in exports year over year. Today, Asia dominates the export market, but North American destinations are growing the fastest. Currently, China is by far our biggest market, but domestic policies have experts projecting a population decrease of as much as 720 million over the next two decades. That means demand in that market is likely to decline. It is imperative that we develop new markets for our agricultural output. Our growth potential there for the long term does not match the near term.

ISA has already begun cultivating new markets, including Southeast Asia (Vietnam, Bangladesh, Thailand); Africa (sub-Saharan and Indonesia); and South Asia, specifically India, where the ISA co-funded Soy Excellence Center recently opened. And we’ll also continue to see growth in South America and Mexico.

Illinois agriculture is some of the most productive in the world. The combined efforts of ISA and others translate to an anticipated 15 percent to 30 percent increase in Illinois agricultural productivity over the next 20 years. Will our current transportation system meet the needs of our growth? How do we ensure that we can continue to get our products to these new markets?

The answer: Our transportation system in the future will need to be more resilient and adaptive in its capacity. As part of our growth strategy, ISA has commissioned a series of studies analyzing the state’s transportation infrastructure. Civil Design Inc. in St. Louis recently completed the first study, “Transportation Network Evaluation of Soybean and Soy Product Movements.” It focused on examining transportation conditions, capacity and networks able to support soybean production growth and resilience.

The results will allow us to identify transportation network gaps and opportunities to improve how Illinois soy producers get their products to market. Future studies will identify opportunities to optimize transportation modes and maintain and even increase the competitive advantage for Illinois producers.

These are key questions for building the ag-centric transportation system we need. Here’s a look at what we’ve found so far.

Road

At the crossroads of the nation, Illinois ranks third in highway miles (behind California and Texas). The 2022 Report Card for Illinois from the American Society of Civil Engineers assigned the state roadways a grade of D+. Bridges are a particular concern, with 52 percent in poor or fair condition.

Thankfully, $1.4 billion in bridge-specific funding is now available for Illinois from the federal Infrastructure Investment and Jobs Act. ISA launched a Bridge Bundling toolkit to help identify the most effective way to move forward.

Those highways and bridges are the critical first step in soybean transportation—the initial mode from the farm. An estimated 86 percent of Illinois soybean production is accessible in a 30-minute drive to roadways the state has identified as a Primary Freight Network (PFN). Maintenance on those key roadways is critical, but equally important is how to access the remaining 14 percent that are too far away from the PFN.

A complicating factor: The freight supply chain that utilizes the PFN is complex and contains many moving parts. Added to that, many different parties own and operate across the supply chain.

ACTION: The study suggests a key first step: Form coalitions to identify transportation challenges and opportunities as they arise. Then develop a strategic plan, incorporating local bridge projects, to provide economic benefits to soy industry stakeholders within host communities across the state.

Rail

Illinois has not only the most track miles of any state but also the most railroads, and we lead the country in originated tonnage. The state is at the heart of the North American rail network—it is the primary hub where eastern, western and Canadian Class I railroads meet and exchange cargo. In fact, each of the six Class I railroads serves Illinois.

Single carrier routes directly connect Illinois with the Pacific Ocean via Vancouver, British Columbia, in Canada, and Michoacán (de Ocampo), Mexico. This provides a competitive advantage compared to California or Washington ports. Multiple single carrier routes connect Illinois to the Gulf of Mexico between Alabama and Veracruz, Mexico.

Trains are critical to soybean movement, especially from grain elevators. A train can handle the cargo of 400 trucks, but to do so, it would have to load and unload in 24 hours. Very few soybean freight corridors can load and unload that much freight. We must bolster and sustain our rail system advantage.

ACTION: Maintain an ongoing dialogue with Class I railroads to leverage individual railroad development, such as the renovations and improvements to the rail yard in Dupo, Ill., by Union Pacific Railroad. Support and expand Class II and III railroad service and the infrastructure conditions plus other mode connections on a case-by-case basis. Specifically:

- Increase funding to improve access to the North American rail-served industrial parks, e.g., Savannah Industrial Hub and the Port of Kaskaskia. This will support host communities and reduce the cost of soybean first- and last-mile transportation cost.

- Explore the selective modification of frac sand unit train loading facilities and repurpose this infrastructure to load beans directly to unit trains. (A site is available in Rochelle.)

River & Ocean

Illinois’ inland waterways, especially the locks and dams on the Mississippi, Illinois, Ohio and Kaskaskia rivers, are critically important to bulk soybean movement. “Investing in waterways is critical,” says Main.

The state’s waterways have seen dramatic, 30- to 40-ft. swings in water levels thanks to extreme weather events. This, along with increased freight volumes and heightened time sensitivity, makes our locks and dams a priority. Simply put, they are aged and in desperate need of restoration and selective upgrading. Their condition, as well as the channel dredging and channel conditions, are considered substandard by American Society of Civil Engineers evaluations.

Port developments both on inland waterways as well as Great Lakes and oceans heavily influence how soy products move to market. Product containerization will expand the shipping options, as long as the carrier schedule and ship-loading criteria can be met.

ACTION: Engage stakeholders to build support for funding while mitigating any adverse impacts that may arise. Monitor the transportation sector’s effectiveness in moving soybeans and products to market, domestically and internationally, where data is available. Specifically:

- Expand the modal choice options and route diversity by increasing awareness of the Great Lakes and St. Lawrence Seaway ports in the U.S. and Canada. Spotlight directly connected ports on the Atlantic Ocean.

- Explore the Great Lakes and Saint Lawrence Seaway network as an option to reduce greenhouse gas emissions for export products. This body of water can be accessed by barges from the Illinois River and moved to the Port of Milwaukee’s new handymax vessel hub for export.

Sustainability

Sustainability remains a key benefit for Illinois soybeans, and we can leverage that to our benefit, especially as global buyers and customers increasingly call for transparency in environmentally conscious production and sourcing.

Our soybeans have a distinct advantage—the lowest carbon footprint compared to soy from other global origins. For generations, we’ve been using sustainable techniques such as crop rotation and nutrient management to produce our soybeans, and we continue to find new ways to advance our practices with precision ag technology, data monitoring and other advanced solutions.

We can combine sustainability and transportation to communicate those benefits to potential global customers.

ACTION: Educate, educate, educate. Create tools to tell the story of Illinois soybean benefits, and factor sustainability into transportation options. Specifically:

- Create an Illinois soybean exports carbon calculator that buyers can use to see the estimated carbon footprint for our products.

- Focus exports on shorter, green trade routes, which will reduce overall greenhouse gas emissions and boost North American trade volumes.

What’s Next?

Illinois’ placement at the center of the North American and U.S. road, railway and waterway networks compounds the effect of our aging transportation infrastructure. We need to act quickly and proactively in order to be ready for as much as 30 percent more volume for those systems to move.

In addition to evaluating the options we’ve reviewed in this article, the second study in the series is underway and will continue through August 2025. With it, we’re taking a deeper dive into our transportation infrastructure and network configurations. We’re asking questions including:

- What soy transportation corridors emit the least carbon?

- How can we best achieve economies of scale?

- Is containerization an opportunity for select production areas?

- Are there deficient roads, rail or marine corridors that are essential to exports?

- Are resources available to help rural areas, and their residents and freight communities, improve access or address decarbonization, including grant funding?

- Are there opportunities to repurpose and restore former freight facilities and networks, as well as former industrial and commercial facilities, to enhance soybean and soy product movements to end markets?

Illinois’ transportation infrastructure leads the way in soybean exporting and logistics, and we need to make sure ag is top of mind in any plans for improvement and upgrades. That’s why ISA is leading the way in actively engaging leadership and spotlighting the fundamental issues agriculture faces as a whole. This will ensure we continue to grow the value of soybeans at home and around the world.

Recent Articles

In this issue of Illinois Field & Bean Magazine, we're looking forward to the 2026 Soybean Summit.

By

Sulfur is essential for plant growth, yet it's only just becoming a common addition to fertilizer management plans. This shift is no coincidence.

By Darby Danzl, ISA Regional Technical Agronomist