Tips to position your farm for the long term

It’s not breaking news that interest rates are high. But what if we told you interest rates are high, but you can do something better position your farm to weather the cycle?

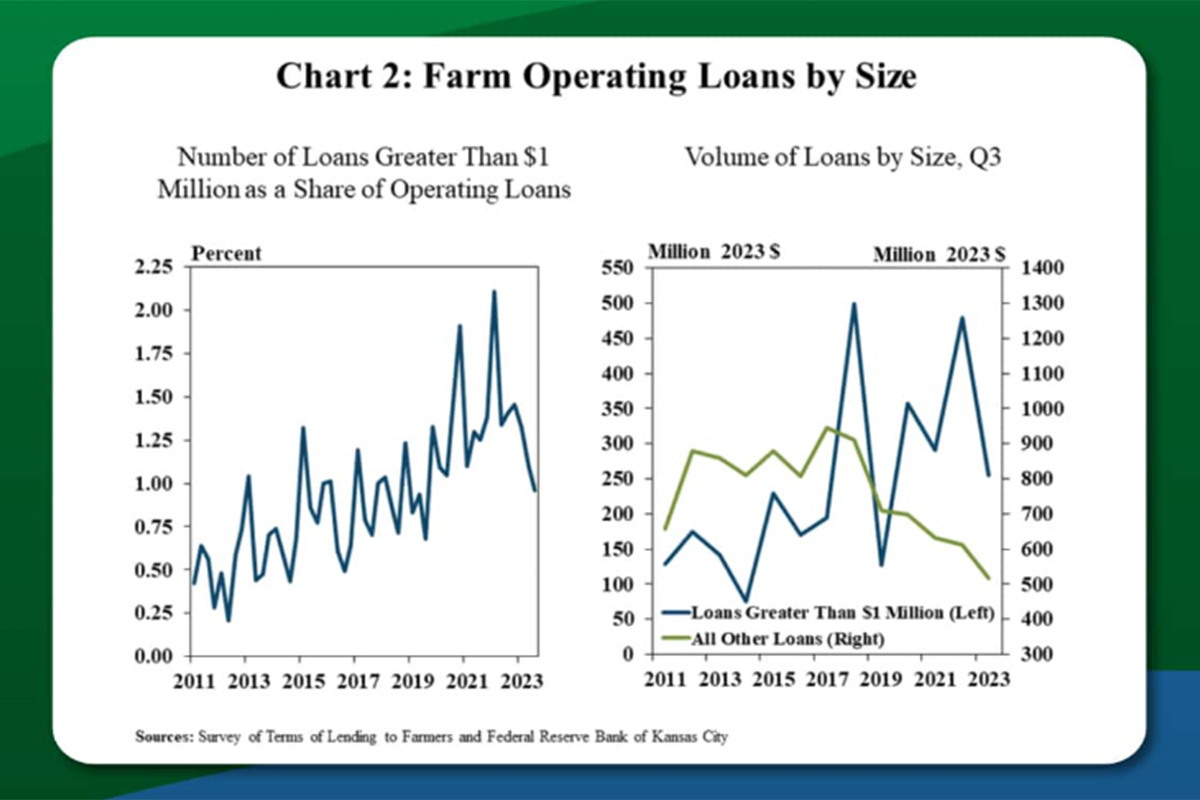

The Kansas City Fed reports agricultural interest rates on operating loans sit at 8.83 percent as of this writing, not only higher than last year but higher than the long-term average of 8.23 percent. After adjusting for inflation, USDA’s Economic Research Service forecasts net farm income to decrease 27.1 percent in 2024 relative to 2023—leaving it 1.7 percent below the 20-year average (2003-2022). Some experts still predict the Federal Reserve could lower interest rates in 2024, but when remains a mystery.

That means smart farming starts not just with precision technology but also with a new approach to financial management.

Case in point: It used to go without saying that paying down debt should be among your first financial priorities. But in the high-interest-rate climate of 2024, that might not make the most sense—in fact, it could end up costing you more in the long term.

It’s harder than ever to predict what’s coming for any farm, and using all of your cash reserves to pay down or limit debt might leave you in a precarious position. That’s particularly true if things get worse before they get better. Financial experts offer three key strategies to help your farm better weather the current high-interest rate cycle.

First, take a hard look at your cash flow. Know exactly what is coming in via receivables as well as the forecasted payables you’ll have flowing out.

Working capital should play heavily into your plan. Look at your operating expenses from month to month and determine your requirement for working capital. That is the number you should target to have in reserve for the proverbial rainy day.

If you have money markets and short-term investment accounts, this is the time to leverage them. Consider that as excess cash that you can use to keep the farm rolling.

Key questions to ask:

- How much working capital does my farm require for month-to-month operation?

- Do my money markets and short-term investments earn enough to hold them static?

- Could they work better for me as operating cash?

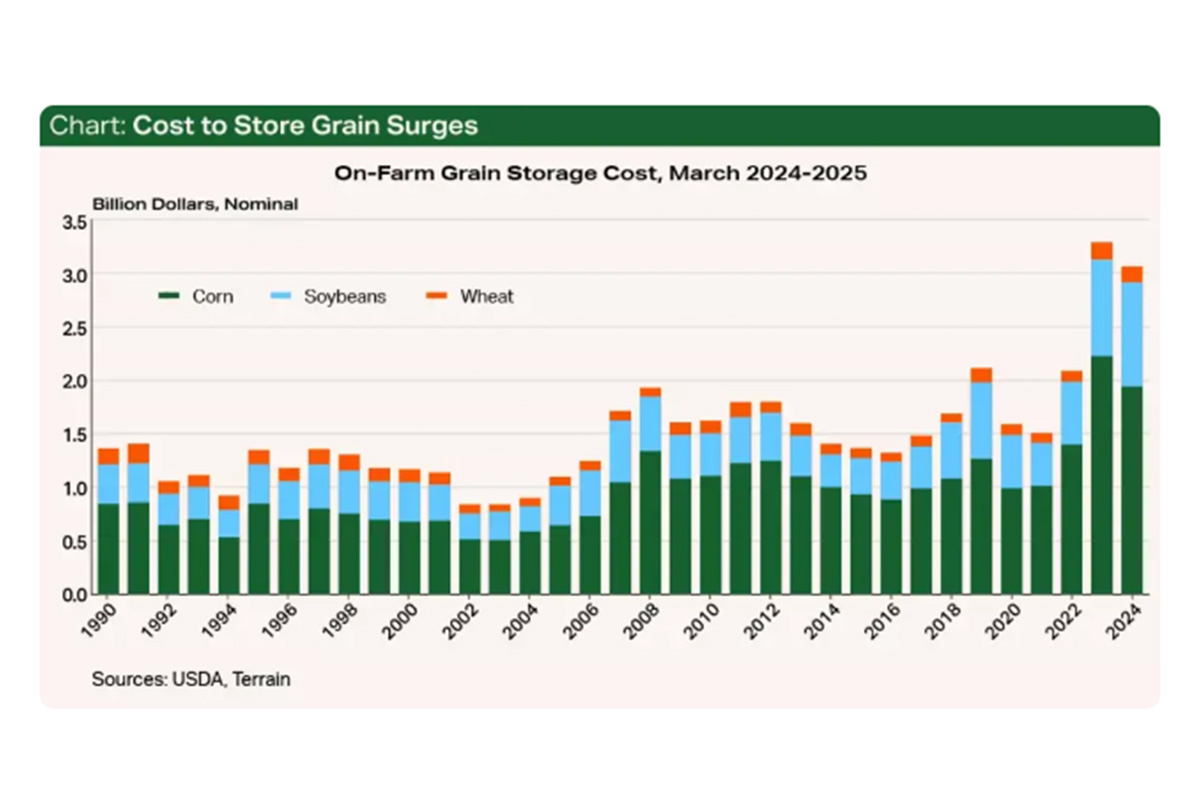

Next, take a hard look at the amount of debt you are carrying in relation to the value of the grain you are holding for sale.

Equally important as rates is how much debt your farm uses and carries. For example, longer repayment terms might keep payments low, but it’s important to consider the composition of debt on your farm before committing.

Your grain marketing plan should already contain a risk management component, and now is the time to take a closer look and potentially retool that. We’re more than halfway through the year, and much has changed since you made the plan. It might be time to tweak your risk tolerance level in accordance with market developments and your own crop projections.

Key questions to ask:

- What does it cost to take grain to market later versus now?

- Does the sell price cover the interest rate I’m paying?

- Could I benefit more by converting that inventory to cash?

Finally, examine your lending options through a new lens. Hard times call for hard decisions. Your trusted lender simply might not be able to give you the most competitive rate, and it might be time to consider alternative lenders.

Alternative ag lenders provide options that many traditional lenders might not be able to offer, such as the flexibility of interest-only payments for debt consolidation. These alternative lenders are sometimes able to customize more than traditional lenders, creating packages based on specific farm needs.

Tap into the insights of your tax adviser, accountant and farm attorney, and ask them for thoughts and strategies. You might be looking to increase your cash flow while keeping ownership. You might be open to outside-the-box agreements where you share profit and loss with the lender. With an alternative lender, many different options are out there. It’s important to consult with a variety of your stakeholders and advisers to ensure you’re examining the offer from all sides, including cash flow, taxes and FSA payment impact.

The cost for on-farm grain storage has soared since 2022, making it more important to analyze the value of stored grain against the option of paying down or lessening the acquisition of additional debt. Credit: Farm Credit Services of America

Compared to recent years, the size of higher-interest-rate farm operating loans in 2024 has decreased Credit: Pinion Global

Key questions to ask:

- Are there other lending resources I could explore?

- Could an alternative lender provide a solution for my farm

Bottom line: Run your numbers, and know where you stand. Review regularly and keep updating your projections. Above all, keep your mind open and ready for new strategies.

Recent Articles

As it celebrates its one-year anniversary, the ISA Soy Innovation Center is dedicated to facilitating the research and commercialization of new and innovative soy-based products with a focus on three primary categories: textiles, bio-lubricants and industrial applications.

By IL Field & Bean Team

Did you know soy can be used to replace nearly any product made from petroleum—including plastics? Soy-based plastics offer a nontoxic alternative to everyday items, contributing to sustainability and representing an exciting opportunity to drive demand for Illinois soy.

By Dylan Karis, Lead Chemist, Airable Research Lab