By IL Field & Bean Team

Whether they are working on tractors in the shop or on chainsaws and weedeaters in the garage, Illinois soybean growers are no strangers to the intricate workings of heavy equipment. But what if the lubricants you purchase to keep your equipment in top shape could also increase the demand for the commodity you work hard to produce year after year?

Bio-based lubricants, which are lubricants derived from renewable feedstocks, provide a green alternative to traditional petroleum-based lubricants.

“A lot of companies are looking to improve their sustainability, and so using certified bio-based products are a way to achieve that goal,” said Todd Main, Director of Market Development for the Illinois Soybean Association.

Not only do these lubricants offer a green alternative for companies, they also create an opportunity to put more money in soybean growers’ pockets.

Supply and Demand

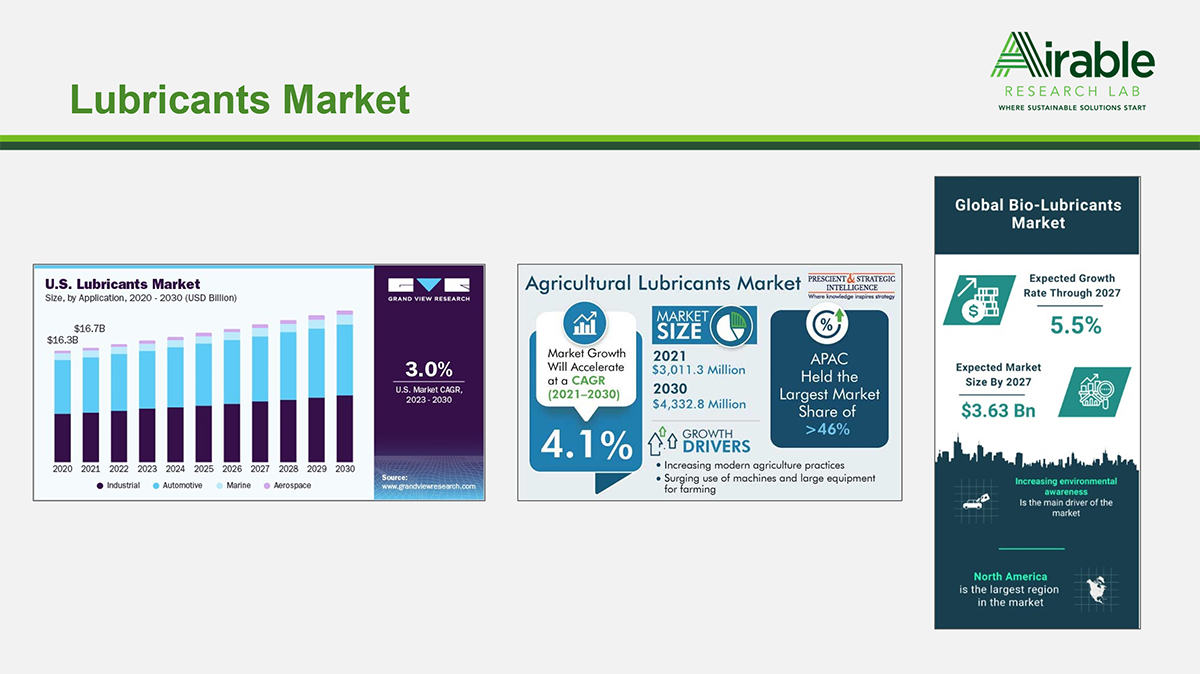

According to Industry Arc, as of 2023, the bio-based lubricant market was valued at more than $26.5 billion and is expected to grow to $38.2 billion by 2030. Several factors can be attributed to the anticipated growth in this sector of the lubricants market. They include increased concerns about environmental sustainability. Other contributing factors include the drive to lessen reliance on fossil fuels and the benefits that bio-based lubricants provide, such as biodegradability, reduced carbon footprints, and lower toxicity.

The good news for Illinois soybean growers is there’s a healthy demand for soy-based lubricants driven by a variety of industrial uses.

An Alternative to “Total-Loss Lubricants”

“Most greases are petroleum greases, and the whole idea here is to replace them with bio-based greases because that’s where the market is going and that’s what consumers are wanting,” said Barry McGraw, Chief Lab Officer for Airable Research Lab.

“We’ve done a ton [of work] in lubricants,” he added. “Companies refer to petroleum-based lubricants as a ‘total loss lubricant’ because you’re using it and then it goes into the ground and environment.”

Increased pressure to produce environmentally friendly products makes soy-based lubricants a perfect alternative.

“We do a lot of lubricant work in the oil and gas [industry]. If you think of oil and gas drilling for pipelines, you need lubricants for down-hole drilling so that things don’t break. We developed a lubricant for LFS Chemistry, and they develop bio-based chemistries for the oil and gas industry. We licensed that technology to them, they’ve had two field trials, we will scale this up. It will start to be sold in the industry within the next month or two,” said McGraw.

The automotive, mining, construction, gas and oil, and of course, agriculture industries are all large consumers of lubricants like the ones being developed at Airable.

Whether it’s engine oil, hydraulic fluid, or grease, the demand for these products is not going away. Neither is the pressure to continue to improve sustainability measures. That’s where soy-based lubricants come into play.

Experts in Soy-Based Chemistry

“We’re the only research and development company in the world that’s only focused on one raw material, so we are becoming experts in soy-based chemistries with respect to consumer and industrial uses,” said McGraw.

Airable is a business line of Ohio Soybean Council, and while it started there, “we thought ‘why not get other states involved?’ So half of our budget is funded by Ohio, while the other half is funded by six other Qualified State Soybean Boards (QSSBs), including Illinois Soybean Association,” said McGraw.

The lab boasts several commercialized soy-based products, including a DeWalt bar and chain oil that can be found in big box stores across the U.S., including Ace Hardware, Lowe’s, and Home Depot.

“Airable only works with commercial industrial companies,” McGraw explained. “Dynamic Green Products (DGP) is one of our key clients, which is the manufacturer for Stanley Black & Decker products.”

Their role in production of soy-based lubricants begins with research and development and extends through to product commercialization and licensing.

“When we develop these technologies, we don’t manufacture them; we license the technology to companies like DGP or Stanley Black & Decker,” he explained. “Once they start selling that product, then Airable gets a percentage of royalty back, and because we are a nonprofit, that money goes right back into research.”

Not only does the licensing of a technology put more money toward research for soy products, but it also benefits the QSSBs that are part of Airable, including ISA.

“The QSSBs get a percentage of that royalty and get to do what they wish with it,” McGraw added.

Weighing the Pros and Cons

When it comes to a soy-based lubricant, McGraw has found that, “it’s not going to be less expensive than petroleum-based lubricants, but consumers are willing to pay more for it.”

He added, “in grease there’s potential to be competitive with pricing, and the performance is comparable. In the oil and gas market, the customers love it. The price is close to what they were already using, and it performs really well.”

When it comes to the DeWalt bar and chain oil, “it has shown better performance than petroleum-based products. There’s less gumming on the chain, people have said that the sharpness of their chains lasts longer, it doesn’t give off fumes like petroleum-based lubricants, and it’s biodegradable.”

Although the case for soy-based lubricants is strong, McGraw noted that there are still obstacles to overcome.

The Biggest Challenge

“The value chain,” said McGraw. “Companies have been using petroleum in the grease market for as long as petroleum has been around.”

He explained that companies are “used to using different feedstocks, so trying to convince them to convert to different feedstocks,” there are several barriers. “It’s not only the cost, but also about sourcing. Sometimes it’s a lot of education and helping them to understand that soy is a commodity, and there is a lot of it.”

Unsurprisingly, companies “want to know how they can be guaranteed a sustainable amount of product.

On more than one occasion, McGraw has found himself going beyond his duties in the lab to connect buyers with suppliers.

“A lot of customers come to us and have no clue what’s available. Sometimes they ask for something that’s already available, so we will connect them to the value chain.”

The other obstacle for soy-based lubricants in the market is price.

“Before you do any chemistry, you are starting with a higher price,” said McGraw. To be competitive, Airable must find other ways to add value to overcome the cost barrier.

“You have to figure out whether it will last longer because that can make up the price difference. Or does it have an added functionality? Those are the challenges to prove to a potential client.”

At the end of the day, McGraw puts it this way: “OK, it costs more but it lasts longer, it’s better for the environment, and consumers are wanting it. Your tools can last longer, for example with the bar and chain oil, which is also saving equipment costs.”

At ISA, “our objective is to expand opportunities for people to purchase more soybeans, and we think that this soy-based lubricant market is worth exploring to help increase demand for Illinois soybeans,” said Main. “In March of 2023, we launched the Soy Innovation Center to support our stated goal of increasing demand for soy and expanding the uses for soy in everyday products.”

To learn more about the Soy Innovation Center and ISA’s efforts to increase new uses for soybeans, visit SoyInnovationCenter.com.

Source: Airable Research Lab, Ohio Soybean Council

Recent Articles

TikTok sensation Jackson Laux, age 9, partners with John Deere to inspire agriculture's future.

By IL Field & Bean Team