While we are well into 2025, it is time to reflect on the soybean industry and both the success and challenges we have seen throughout the last market year. The U.S. soybean industry experienced a dynamic and competitive 2023-2024 marketing year, marked by strong production, robust global demand, and evolving export challenges. Let’s take a closer look at some of the most important trends and developments shaping the soybean market.

Soybean Production and Acreage

U.S. soybean production in 2023 was solid, benefiting from favorable weather conditions and stable acreage in production. The USDA’s estimates suggest that production levels ensured a competitive supply for domestic and international markets. Year after year, a steady flow of soybeans leaves the state of Illinois to reach destinations around the world. Illinois’ unique geographic position enables agricultural exports to travel along the inland waterways, the Great Lakes, and most importantly the Mississippi River. Reaching 60%, the majority of soybeans produced in the state are exported. This steady production was crucial in meeting the ongoing demand for U.S. soybeans, particularly in key export markets.

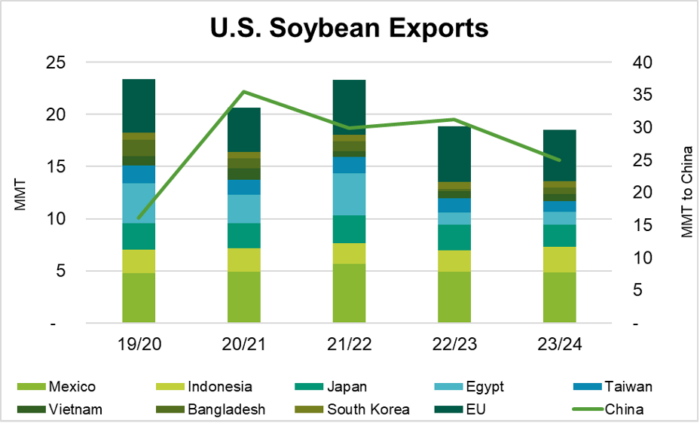

The Role of China in U.S. Soybean Exports

China continued to be the largest importer of U.S. soybeans in 2023/2024, driven by its ever-growing need for soybeans to meet their crush capacity and produce livestock feed. While export volumes were strong, the pace of exports was somewhat influenced by trade policy shifts and broader geopolitical tensions.

Competition from South America

Brazil’s soybean production capacity remains a powerful force in global markets. The country’s larger harvests and competitive pricing put pressure on U.S. exports, especially in regions like Asia and South America. However, the U.S. maintained a critical presence in key global markets such as Mexico, the European Union (EU), Indonesia, and Japan, where demand for high-quality U.S. soybeans and meal remained robust.

Export Volumes and Logistical Challenges

While U.S. soybean exports held steady, they were not without challenges. Logistical issues, such as port congestion and higher shipping costs, impacted the ability to move products efficiently, particularly during peak export seasons. These disruptions were particularly pronounced as demand surged in late 2023. Additionally, Brazil’s favorable currency exchange rate and good harvest created further competition. Despite these logistical and competitive hurdles, U.S. pricing remained competitive, especially in markets where high-quality products were in high demand.

Global Demand: A Driving Force

The global demand for soybeans remained strong in 2023/2024, driven primarily by the need for animal feed in major livestock-producing nations such as China, the European Union, and Southeast Asia. This sustained demand provided crucial support for U.S. soybean exports, despite the increased competition from South American suppliers. As countries continued to expand their livestock and poultry sectors, the need for protein-rich feed ingredients, such as soybeans, showed no signs of slowing down.

Leading Export Markets

Year-over-year, total soybean exports have declined 14% to 46.1 MMT. This largely occurred on the heels of China’s lower demand, which declined 20% from 31.2 MMT to nearly 25 MMT. Notable increases in imports include: Indonesia (+18%), Egypt (+5%), Vietnam (+7%), and Bangladesh (+174%).

- China: The dominant player in U.S. soybean exports, with demand driven by the livestock feed sector.

- Mexico: Consistent and growing demand, bolstered by proximity and the USMCA trade agreement.

- European Union: A major buyer, particularly for high-quality, sustainable soybean meal used in animal feed.

- Japan: Focused on high-quality soybeans for food products like tofu and soy milk.

- Southeast Asia (Indonesia, Vietnam, Philippines): Growing markets due to expanding livestock industries and rising incomes.

- Taiwan: A stable market, with steady demand for soybeans primarily for animal feed.

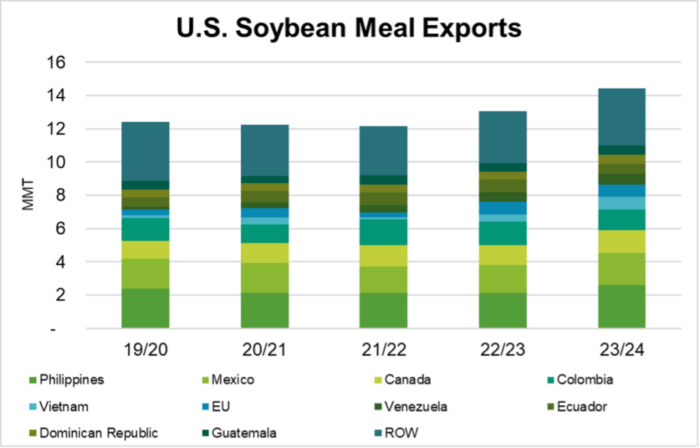

Top markets for soybean meal:

Year-over-year, total soybean meal exports have increased 10% from 13.1 MMT to 14.4 MMT.

- Philippines (+21%): Increasing demand, particularly from the expanding poultry and aquaculture industries.

- Mexico (+15%): The largest importer of U.S. soybean meal, with a growing livestock sector reliant on this key protein source.

- Canada (+14%): A consistent buyer due to the importance of soybean meal in the Canadian livestock industry.

- Colombia (-9%): A significant livestock and aquaculture production market.

- Vietnam (+80%): A rapidly expanding market, driven by its growing poultry and aquaculture industries.

- European Union (-9%): A major importer, with significant demand from countries like the Netherlands, Germany, and Spain.

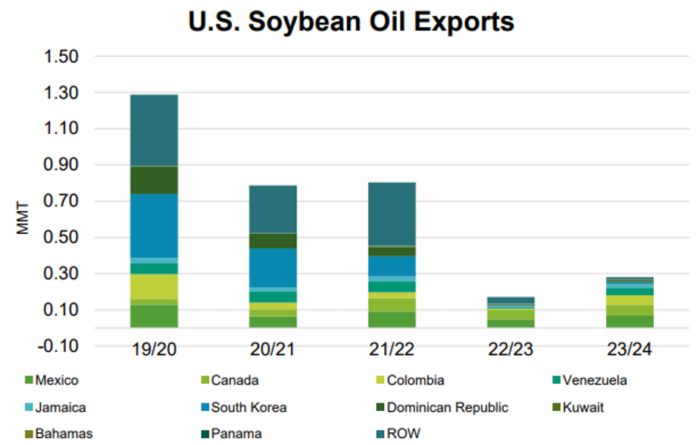

Soybean Oil

Soybean oil exports in general have declined significantly (-78%) from 19/20 to 23/24. Last year showed demand from a relatively different customer base than in previous years. In the 19/20 MY, the top markets were: South Korea, the Dominican Republic, Colombia, Mexico, and Guatemala.

Top markets for soybean oil:

- Mexico

- Canada

- Colombia

- Venezuela

- Jamaica

The Market Development team at the Illinois Soybean Association serves as ‘customer service representatives’ for soybeans on a national and global level to ensure customers are aware of the quality, consistency, and sustainability of Illinois soybeans. Not only does ISA work to enhance the visibility of the soybeans grown here, but ISA also leverages the farmers who put in countless hours to ensure the world is fed.

In 2024, our team hosted 15 trade teams including grain buyers, processors, livestock feeders, and consulates from Latin America, the European Union, Southeast Asia, and the Greater China region. Each of these visits provided some of our biggest trade partners the opportunity to interact with farmers and staff and bring a newfound appreciation for the production of soybeans back to their companies.

Whether looking to major trade partners or developing markets, global demand drives the soybean market, and the U.S. must remain competitive in price and superior in the quality of soybeans. Staff, farmers, and industry stakeholders must unite as we continue innovating and propel the soybean industry forward.